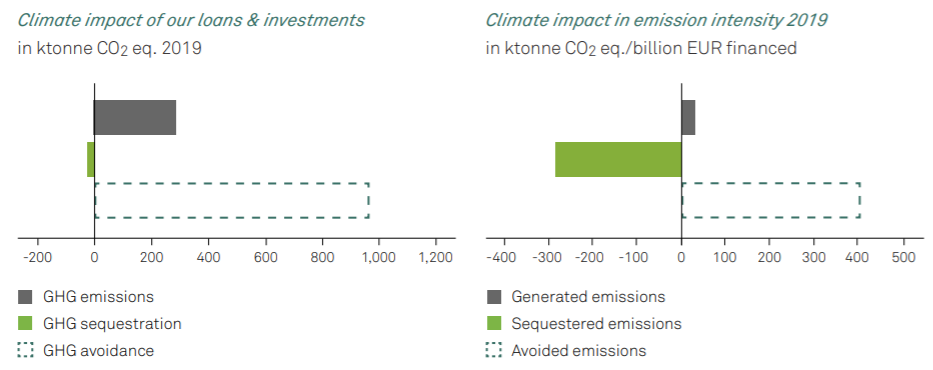

April 9, 2020 – Triodos Bank published on March 19th the 2019 greenhouse gas emissions associated with the bank’s outstanding loans and investments. The disclosure covers emissions financed by 100% of its portfolio (€12 billion), which includes business loans, project finance, residential mortgages and investments.

This is a step up of Triodos Bank’s carbon accounting efforts, a values-based bank that started disclosing financed emissions from around 68% of its portfolio in 2018 and moved to 100% in 2019. Their objective is to be transparent about the climate impact of their loans and investments and use this information, ultimately, to set climate targets and steer investments towards a low-carbon economy.

Triodos Bank measured these emissions in accordance with the carbon accounting methods developed by the Partnership for Carbon Accounting Financials (PCAF). The emission disclosure is published in Triodos Bank’s Annual Report 2019.

In addition to absolute emissions, Triodos Bank reports the climate impact in emission intensity (emissions per EUR financed). Although this is a key indicator for its stakeholders, the bank notes that “limiting, and then reducing, absolute greenhouse gas emissions is what’s required to enable us to live within the planet’s environmental limits”.

Source: Triodos Bank 2019 Annual Report

Triodos Bank’s financed emissions provide a baseline to improve and monitor their progress in working with their customers to reduce their emissions. In 2020 Triodos Bank expects to use the newly developed science-based target methodology for the financial industry to set climate targets for key sectors. The level of avoided and sequestered emissions they finance provides insight on how the bank can identify innovative products that contribute to achieving the Paris Agreement’s goals and ultimately steer towards a low-carbon economy.

Download Triodos Bank 2019 Annual Report

About Triodos Bank

Triodos Bank is in business to help create a society that protects and promotes the quality of life of all its members, and that has human dignity at its core. Since 1980, we have enabled individuals, organisations and businesses to use their money in ways that benefit people and the environment. We promote sustainable development by offering our customers sustainable financial products and high quality service.

About the Partnership for Carbon Accounting Financials

In September 2019, the Partnership for Carbon Accounting Financials (PCAF) was launched globally. Currently, nearly 60 banks and investors have subscribed to the PCAF initiative. PCAF institutions work together to jointly develop the Global Carbon Accounting Standard for the financial industry to measure and disclose the greenhouse emissions of their loans and investments. By doing so, PCAF institutions take the first step required to assess climate-related risks, set targets in line with the Paris Climate Agreement and develop effective strategies to decarbonize our society. PCAF is organized by a Steering Committee comprised of representatives of ABN AMRO, Amalgamated Bank, ASN Bank, Global Alliance for Banking on Values (GABV) and Triodos Bank.