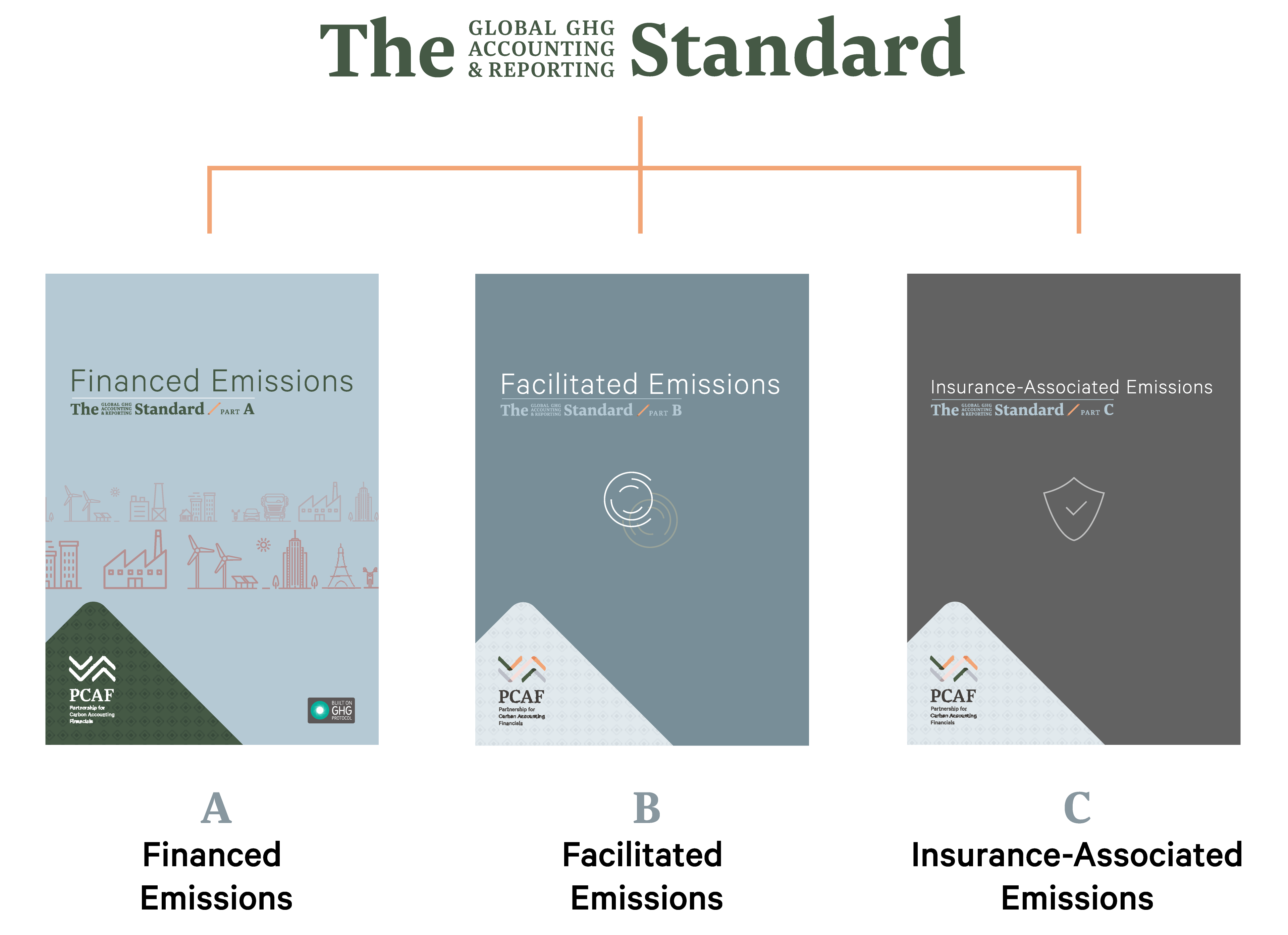

The Global GHG Accounting and Reporting Standard, developed by the PCAF Global Core Team, is comprised of three parts, A, B and C.

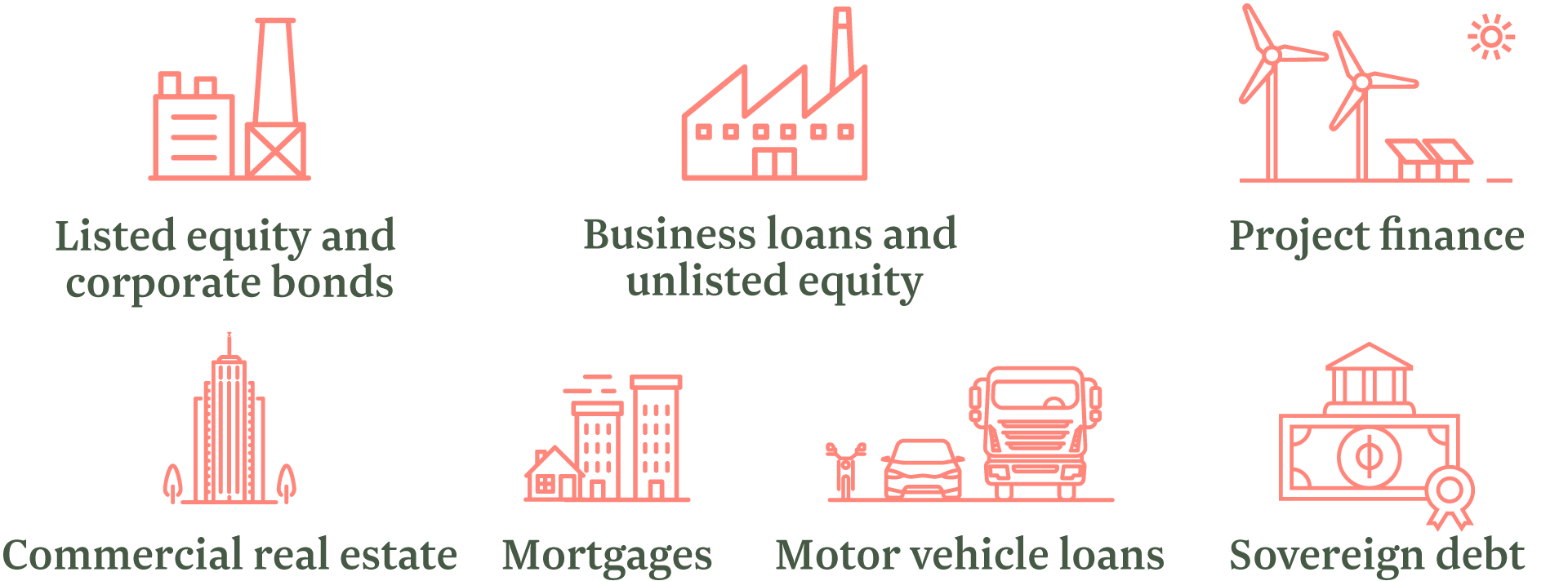

Part A - Financed Emissions provides detailed methodological guidance to measure and disclose GHG emissions associated with seven asset classes as well as guidance on emission removals:

Part B – Facilitated Emissions provides detailed methodological guidance for measuring and reporting the GHG emissions associated with capital markets issuances.

Part C – Insurance-Associated Emissions provides methodological guidance for measuring and reporting the GHG emissions associated to re/insurance underwriting.

As the Standard and PCAF evolve, additional asset classes and case studies will be added to the Standard.

Using this Standard equips financial institutions with harmonized, robust methods to measure financed emissions, a metric that enables them to:

The previous version of the Global GHG Accounting and Reporting Standard is available for reference: Part A – Financed emissions 1st edition (2019)

Built on GHG Protocol

The first edition of this Financed Emissions Standard has been reviewed by the GHG Protocol and is in conformance with the requirements set forth in the Corporate Value Chain (Scope 3) Accounting and Reporting Standard, for Category 15 investment activities. The newly added sovereign debt methodology and guidance on emission removals in this second edition are pending GHG Protocol review and approval.

The PCAF Disclosure Checklist

As part of PCAF’s efforts to drive standardization and quality of GHG emissions reporting, the Technical Assistance team has developed a disclosure checklist to support financial institutions to produce PCAF-aligned disclosures.

From the start of 2025, the PCAF Secretariat will use this checklist in the process of reviewing new disclosures before uploading them to this website, offering greater credibility to both PCAF and our Signatories whilst growing the value-add of having disclosures listed here.

The Disclosure Checklist for Part A Financed Emissions is available for download here.

Download and read the Frequently Asked Questions about Insurance-Associated Emissions (pdf).

Download and consult the PCAF personal motor industry attribution factor approach (pdf) for more information on the (Industry) attribution factor.

The Global Core Team of PCAF governs the Global GHG Accounting and Reporting Standard for the Financial Industry with the ultimate goal of harmonizing GHG accounting and reporting.

The Global Core Team of PCAF is made up of a diverse group of 14 members representing all regions and types of PCAF signatories to reflect PCAF’s expanding membership.

Core Team members

Chidozie Ezike, United Bank for Africa Plc

Emily Rodgers, EIG

Frida Panayi, Metrics Credit Partners

Giel Linthorst, ING

Hetal Patel, Phoenix Group

Jamie Mattison, Morgan Stanley

Maren Bodenschatz, Swiss Re

Rafael Martins de Oliveira, Itau Unibanco

Samuel Mary, PIMCO

Sharad Tuladhar, NMB Bank

Sharna Bourke, Commonwealth Bank of Australia

Stefan Henningsson, Nordea

Yu Takita, Mizuho Financial Group

Regional implementation teams feed the development of the Global GHG Accounting and Reporting Standard for the Financial Industry through local collaboration.

The PCAF Standard is being implemented in five regions: Africa, Asia-Pacific, Europe, Latin America and North America. Each region has regional implementation teams with a clear governance structure.

Each team receives technical assistance to implement GHG accounting and reporting at no cost. The lessons learned through the regional implementation feed into the refinement of the Global GHG Accounting and Reporting Standard for the Financial Industry.

[...] In order for banks to reduce their impact on global warming, we need to be able to measure what that impact actually is. We recognize the Dutch founders for initiating the open-sourced methodology that PCAF provides as a major step forward. Amalgamated Bank is proud to be a part of this first-of-its-kind partnership and we hope to be joined by many more banks in this endeavor.

Keith Mestrich, CEO Amalgamated Bank

Via the pages below you can access downloads and other resources made available by the the regional implementation teams.